Avalon Premium Trading Signal Group

Welcome To Our Trading Signals Group

Specialized in the creation, optimization, and ongoing management of exchange-based GRID and DCA trading strategy on Bitget and Pionex, as well as classic trading signals. Our signals are shared via Telegram and are designed for traders who want to operate systematic, data-driven, and risk-optimized trading strategies.

We Analyze the Market

We analyze market structure, liquidity, and key price zones to identify potential setups.

Trading Signals via Telegram

Relevant trading signals are shared in detail through our Telegram channel.

Independent Execution

You implement the signals yourself and retain full control over your capital at all times.

Strategy & Analysis Approach

All signals are based on a multi-layered market analysis. By combining these factors, we identify high-probability price zones for deploying setups.

Our Trading Strategies

Our group specializes on standard position setups and exchange-based grid and DCA signals.

Grid Trading

A grid strategy uses a predefined price grid and trades in spot, long, or short mode. Each grid represents an individual buy or sell order designed to generate profits step by step.

DCA Trading

A DCA strategy places additional buy orders at predefined intervals, optimizes the average entry price, and closes the position at a defined take-profit target.

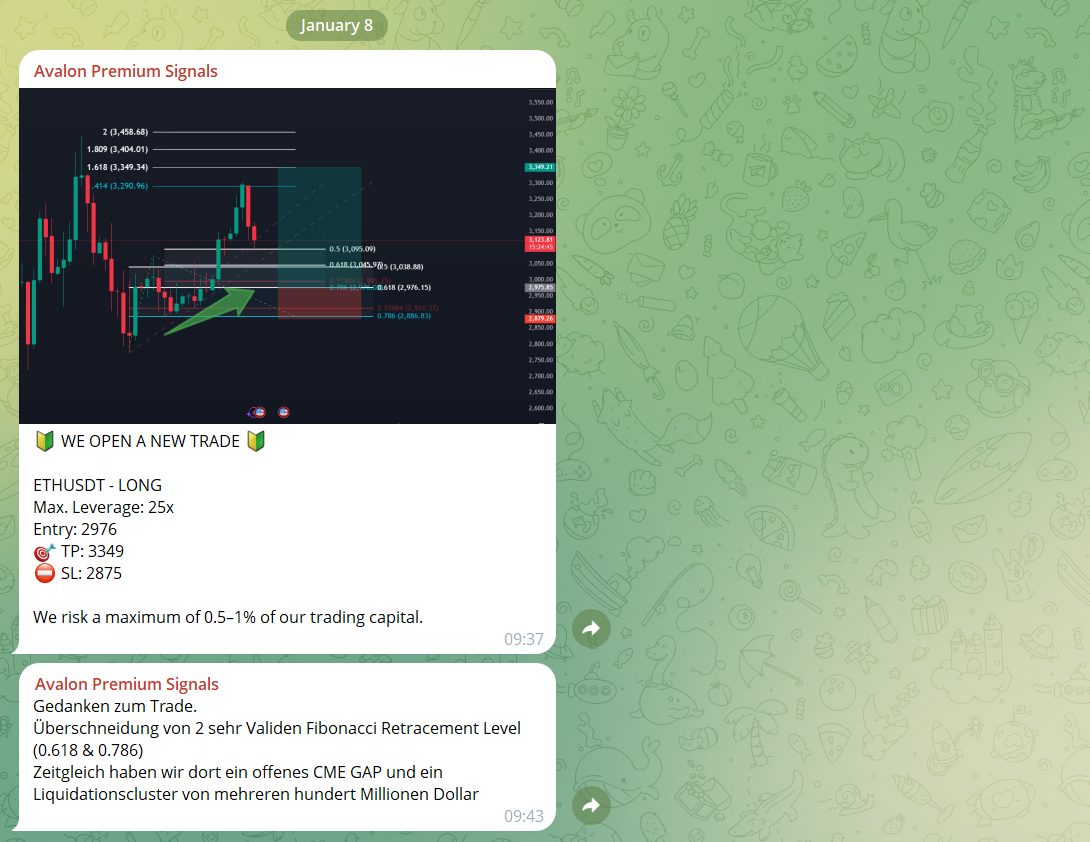

Classic Trading

In classic trading, positions are actively opened and closed based on market analysis, with clearly defined entry, take-profit, and stop-loss targets.

Grid Trading Signals

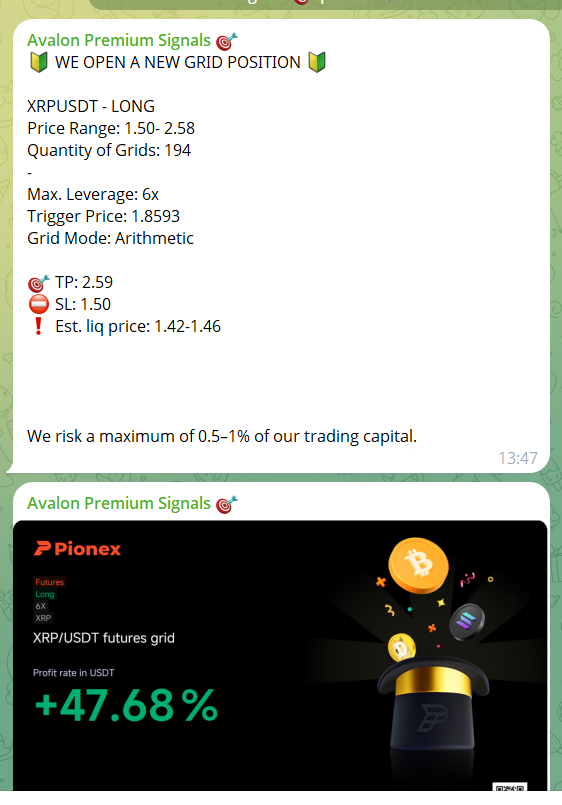

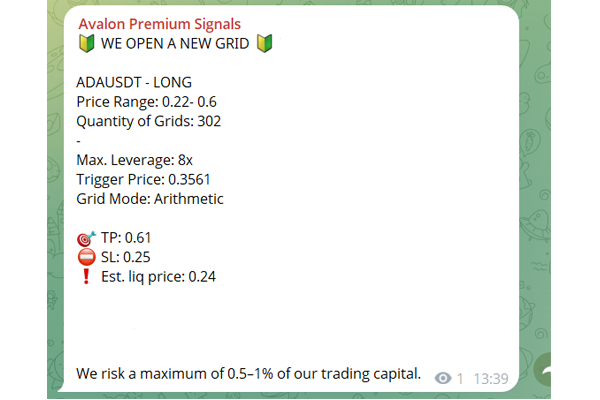

Our grid strategy signals are based on precise market analysis and are deployed exclusively during clearly defined market phases. The following information is shared via Telegram:

Trading Pair & Grid Parameters

Specification of the traded pair, including price range, number of grids, and grid type, tailored to the current market conditions.

Entry Price & Maximum Leverage

Definition of the entry price and applied leverage, always considering a clearly calculated liquidation zone.

Take Profit, Stop Loss & Risk Parameters

Predefined take-profit targets, optional stop loss, and disciplined risk management. Per grid signal, we typically risk a maximum of 0.5–1% of total trading capital.

CLEAR RULES. CLEAR SETUPS.

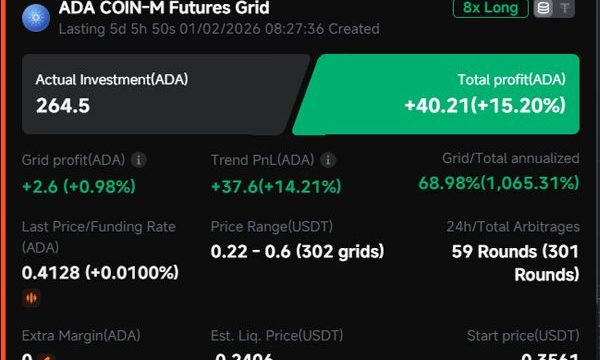

DCA and Classic Trading Signals

Our DCA bot and classic trading signals are always provided with all relevant parameters. This includes maximum leverage, take-profit and stop-loss targets, as well as ongoing risk and position management.

GET STARTED NOW

Transparency & Clear Separation

What We Deliberately Do Not Offer

We do not offer a capital trading service. All signals are created by us directly on the respective exchanges and shared with full transparency.

We trade exclusively with clearly defined risk parameters. No oversized positions, no unnecessary risk — risk management and capital preservation are our top priorities.

Trading involves risk. Despite careful analysis and structured planning, market conditions can and will sometimes move against us. We do not assume any liability for potential losses.

Choose your plan

Access to the signal group is provided via a subscription and includes the following services:

Monthly Subscription

65€

per month

- Access to the Premium Signal Group

- Convenient monthly billing

- Cancel monthly at any time

6-Month Subscription

330€

Save 15%

- Access to the Premium Signal Group

- Convenient semi-annual billing

- Minimum term: 6 months

After Purchase

Once your subscription is completed, you will receive a confirmation email with step-by-step instructions on the next steps You will also be redirected to a thank-you page where the instructions are explained again in detail. On that page, you will find a short form that must be completed so we can grant you access to the Telegram signal group. Access is usually granted immediately, or within a maximum of 24–48 hours.

CANCELLATION You can cancel your subscription at any time via Digistore24, and the cancellation takes effect immediately. In this case, access remains active until the end of the subscription period that has already been paid for. To cancel, click the “Overview” link in your order confirmation email and select the “Cancel” option. Alternatively, you can cancel directly through Digistore24 by providing your order number and the email address used for the purchase.

Digistore24 CancellationPerformance Over the Past Months

While there is no guarantee of future results, we transparently share performance results from recent months to provide insight into our analysis and risk management strategy.

Signals Activated

Profitable

At a Loss

Trading financial instruments and cryptocurrencies involves risk. The provided content, signals, and information do not constitute investment advice and are shared without guarantee. Past performance is not indicative of future results. Each user acts independently and at their own risk.

FAQ

Here you’ll find answers to the most frequently asked questions.

How many signals can I expect?

The number of signals depends on current market conditions. During periods of higher volatility, new setups tend to appear more frequently. However, our clear focus is on quality over quantity, ensuring that only well-structured and meaningful signals are shared.

Can beginners also use the signals?

Yes. The signals are suitable for beginners as well. In addition, we provide detailed guides and tutorial videos that walk you through the process step by step.

Can I simply copy your signals/parameter?

For selected grid setups, there is an option to copy the parameter via one-click execution. However, especially for beginners, we recommend manual execution to develop a better understanding of the strategy and structure.

Does my money stay on the exchange?

Yes. Your funds always remain on your exchange account. We do not manage accounts and have no access to your funds. All setups are created by you and can be adjusted or stopped at any time. We provide signals exclusively for our own grid and DCA setups — execution remains fully under your control.

What is the minimum investment per signal?

The required minimum investment per grid signal varies depending on several factors, including leverage, price range, and the number of grids. To reduce the exchange-imposed minimum investment, parameters such as the number of grids and the leverage can be adjusted. This can lower the minimum investment to approximately $30–40, depending on the setup. For DCA spot setups, the minimum investment is typically around $50–100, depending on the exchange and the selected settings.